Team #PTAandM’s Tax Planning season for 2017 is now off and running. When it comes to Tax Planning we like to leave nothing off the table. This week we talk about how Big Super Contributions can save tax and boost your wealth at the same time.

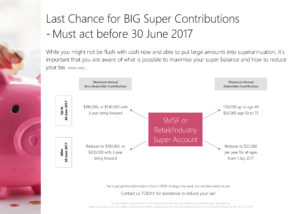

While you might not be flush with cash now and able to put large amounts into superannuation, it’s important that you are aware of what is possible to maximise your super balance and how to reduce your tax. Here’s why …

In the lead-up to 30 June 2017, we want you to be aware of your Last Chance to make BIG Super Contributions.

Watch the 2 min video below to learn how we can help you reduce tax and increase your wealth at the same time.

Imagine what you could do with your tax saved!

- Reduce your home loan

- Top up your Super

- Have a holiday

- Deposit for an investment property

- Pay your children’s education

- Buy a house for your Unicorn

- Upgrade your car

The possibilities are endless! 30 June will be here before we know it. Let us help you get the most out of the upcoming months.

Contact us today to get started.